The recent announcement of new tariffs under the Trump administration has sparked significant attention across industries and markets. These tariffs mark the first wave in a broader trade strategy aimed at reshaping international commerce and protecting American businesses. If you’re wondering what these changes mean for you—whether you’re a consumer, importer, or business owner—it’s essential to understand the key details.

The initial tariffs target a range of imported goods, with a particular focus on products from specific countries, aimed at addressing trade imbalances and unfair practices. Alongside these measures, the government has introduced extended deadlines for compliance and exemptions, giving companies more time to adjust their supply chains and pricing strategies.

While the tariffs are designed to boost domestic manufacturing and safeguard jobs, they also pose potential challenges, including higher costs for certain products and the possibility of retaliatory actions from trading partners. Staying informed about which products are affected, the timelines involved, and the broader economic implications will help you navigate the changes smoothly.

Overview of Trump’s New Tariffs

Trump administration introduced a series of new tariffs as part of its strategy to address trade imbalances and protect American industries. These tariffs mainly target imports from countries where the U.S. government believes unfair trade practices have hurt domestic businesses. The goal is to encourage companies to bring manufacturing back to the U.S. and to strengthen the country’s economic position globally.

The new tariffs encompass a broad range of products, including steel, aluminum, electronics, and various other goods. By imposing additional costs on these imports, the administration hopes to make American-made products more competitive. However, these tariffs also mean higher prices for some imported goods, which could affect both businesses and consumers.

In response to concerns from industries, the government has extended the deadlines for compliance and granted some exemptions, providing companies with more time to adjust. At the same time, trading partners have warned of possible retaliatory tariffs, raising the stakes in ongoing trade negotiations.

Key Objectives Behind the Tariffs

The primary goal of the tariffs introduced by the Trump administration is to protect American industries and workers from unfair foreign competition. By imposing additional duties on certain imported goods, the administration aims to discourage companies from outsourcing production overseas and encourage them to invest more in domestic manufacturing.

Another essential objective is to address trade imbalances. The U.S. has long run large trade deficits with several countries, meaning it imports far more goods and services than it exports. The tariffs are designed to pressure trading partners into negotiating fairer trade agreements that level the playing field for American businesses.

Additionally, the tariffs aim to counteract what the administration describes as unfair trade practices, including the dumping of products at below-market prices or the provision of subsidies to local industries. These measures are intended to create a more equitable global trading environment.

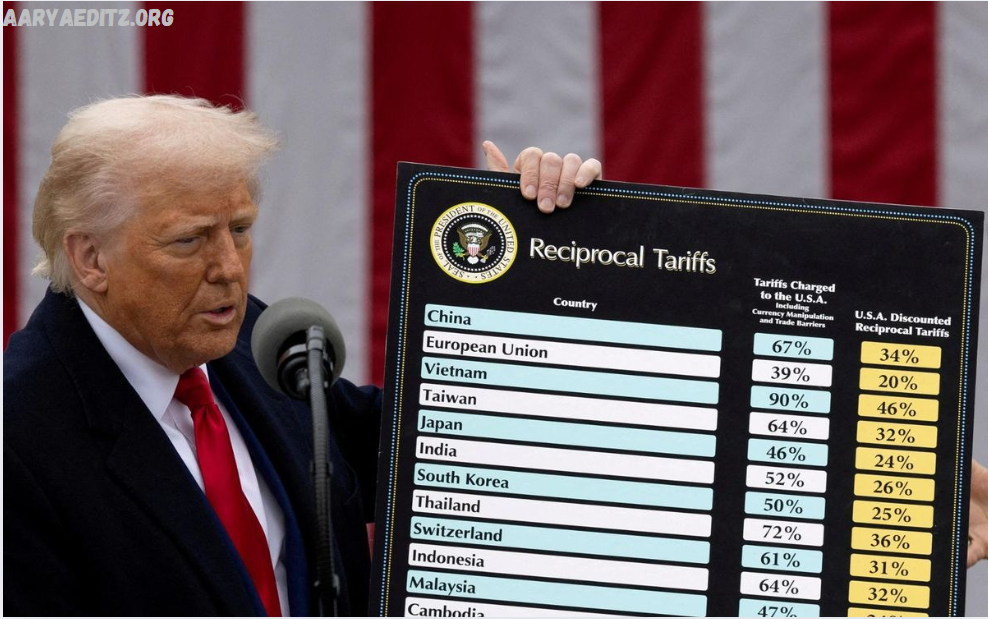

Breakdown of the First Wave of Tariffs

The first wave of tariffs announced by the Trump administration primarily targeted steel and aluminum imports. These tariffs imposed a 25% duty on steel and a 10% duty on aluminum coming into the United States. The goal was to protect American steel and aluminum producers from foreign competition, particularly targeting countries accused of flooding the market with cheap or subsidized metals.

These tariffs applied broadly to most countries, but some allies initially received temporary exemptions to avoid immediate disruption. The administration signaled that these exemptions might be reviewed or removed over time.

Beyond metals, the first wave also included tariffs on certain goods from countries like China, where the U.S. identified unfair trade practices. This included a list of products worth billions of dollars that faced additional import duties, covering items such as machinery, electronics, and consumer goods.

Industries Most Affected by the Tariffs

The new tariffs have had a significant impact on several key industries across the U.S. economy. The steel and aluminum sectors are among the most directly affected, as the tariffs were initially targeted to protect domestic producers in these industries. Companies relying on imported metals, such as automotive manufacturers, construction firms, and machinery producers, have faced higher costs, which can ripple through their pricing and operations.

Another heavily impacted industry is electronics and technology. Many components and finished products in this sector are imported from countries subject to tariffs, leading to increased expenses for manufacturers and potentially higher prices for consumers.

The agricultural sector has also felt the effects, particularly farmers who export goods to countries that retaliate with tariffs. This has created uncertainty and financial strain for producers of soybeans, corn, and other key crops.

Extended Deadlines: What They Mean for Businesses

To ease the impact of the new tariffs, the government has introduced extended deadlines for compliance and exemptions. These extensions provide businesses with more time to adjust to the changing trade environment, without facing immediate penalties or disruptions.

For companies relying on imported goods affected by tariffs, extended deadlines mean extra time to review supply chains, renegotiate contracts, or find alternative sources. This flexibility can be crucial in managing costs and avoiding sudden price spikes.

The extensions also allow businesses to apply for exemptions if they can prove that tariffs would cause significant harm or if the imported products aren’t available domestically. This process helps protect industries that depend on specific materials or components.

Frequently Asked Questions

What are the extended deadlines?

Extended deadlines give businesses more time to comply with the tariffs or apply for exemptions before full enforcement begins.

How might tariffs affect prices?

Tariffs often lead to higher import costs, prices for consumers and businesses relying on those goods.

Will other countries retaliate?

Some countries have announced retaliatory tariffs, which could affect U.S. exports and escalate trade tensions.

How can businesses prepare for these changes?

Businesses should review supply chains, explore alternative suppliers, and stay informed about tariff updates and deadlines.

What is the long-term impact of these tariffs?

The tariffs aim to boost domestic manufacturing and job growth, but may also create short-term challenges, such as higher costs and strained international relations.

Conclusion

Trump’s new tariffs represent a significant shift in U.S. trade policy, aiming to protect American industries and encourage domestic manufacturing. While the first wave of tariffs and extended deadlines provides some flexibility, businesses and consumers alike should prepare for changes in costs and supply chains. Staying informed about which products are affected help you navigate the evolving trade landscape. As these policies continue to grow, keeping a close eye on potential impacts—both positive and challenging—will be essential for making informed decisions moving forward.